Zusammenfassung

Highlights

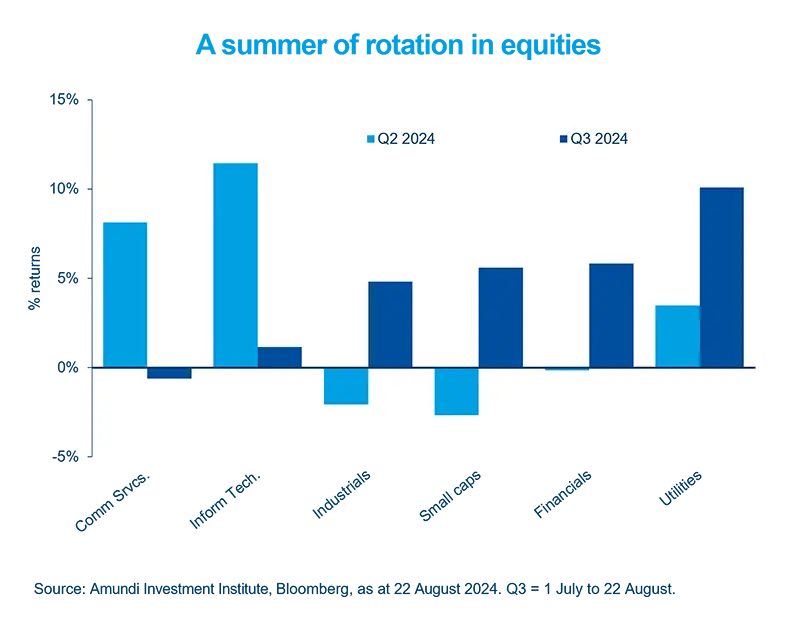

- The market rally seen this year is showing signs of broadening to other sectors.

- A continuation of this rotation depends on corporate earnings, economic growth and rate cuts by central banks.

- Investors should explore attractively priced businesses that show a potential for sustainable growth in earnings.

In this edition

Global equities delivered strong performance this year on the back of resilient economic activity in the US and Europe. Some sectors such as technology outperformed the broader markets led by artificial intelligence-driven exuberance in the US. We are now witnessing signs of a broadening of this rally to other areas such as small caps, financials, that have lagged behind. Notably, August brought some market turbulence due to concerns around excessive optimism on artificial intelligence and disappointing US job market data. Markets have since recovered, but as we approach the final phase of the US elections, uncertainty may persist. Moving forward, market focus will remain on corporate earnings, monetary policy decisions, and economic growth, which could lead to further rotations.

Key dates

|

26 Aug China medium term |

29 Aug US GDP, EZ consumer |

30 Aug GDP: France, Canada, India; |

Read more