Zusammenfassung

In a nutshell

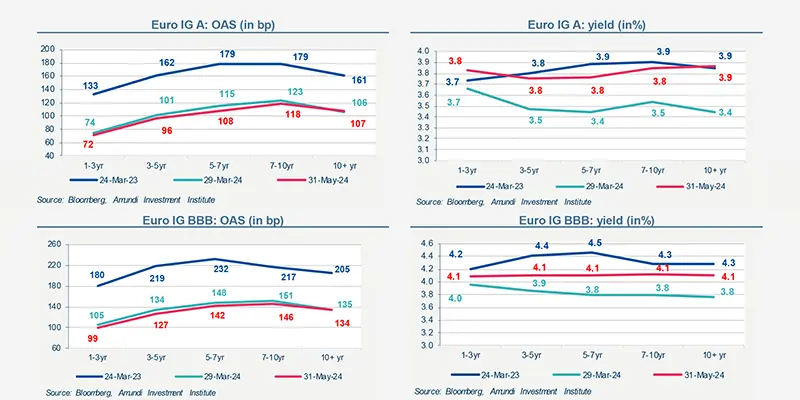

The Euro IG OAS spread has widened slightly in recent days to 109 bp after reaching a low of 106 bp. Euro High Yield OAS is close to 325 bps in mid-June after reaching a low of 313 bps. The overall situation remains positive for risky assets:

- economic activity remains resilient,

- inflation is falling and

- rate cuts remain on the table.

The recent rise in political uncertainty has weighed slightly on euro spreads. With a budget deficit of 5.5% of GDP and an increase in public debt to 110.6% of GDP in 2023, France must reestablish a certain budgetary discipline to return to a deficit below 3%. The market considers to some extent that political fragmentation adds to uncertainty about the budgetary trajectory in France.

European activity was stronger than expected. Euro area real GDP increased 0.33%QoQ in Q1 2024. All major countries beat expectations and growth was the strongest in the south of Europe. The Eurozone’s disinflationary process is well advanced.

The ECB cuts interest rates for the first time in five years as widely expected! Eurozone inflation has made considerable progress toward its target. Christine Lagarde considered the Euro zone inflation is under control after slowing from a peak above 10% in 2022 to 2.6% in May. It is now appropriate to moderate the degree of monetary policy restriction. However, patience remains the most appropriate path. Christine Lagarde confirmed that the ECB is not pre-committed to a particular rate path. Inflation in services is stickier than expected.

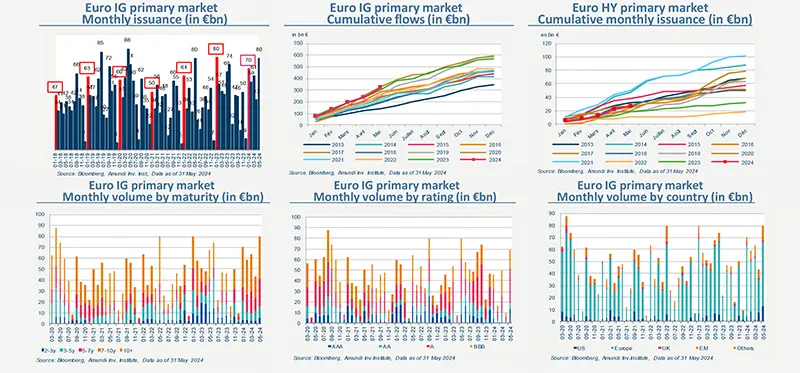

Activity on the corporate primary market remained solid in May.

Primary market Investment Grade

Market data

Find out about our treasury offer