Zusammenfassung

In a nutshell

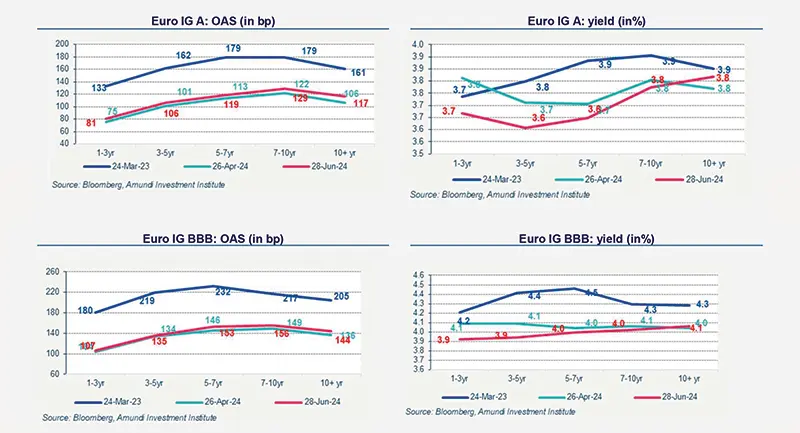

Euro IG spread has tightened in recent days to 103bps after reaching a high of 122bps mid- June. Euro High Yield spread is close to 334 bps in mid-June after reaching a high of 350 bps mid-June.

The overall situation remains positive for credit market:

- economic activity remains resilient

- inflation is falling

- rate cuts remain on the table

The demand for fixed income products remains strong: investors want to fix in higher rates before central banks start cutting rates.

The ECB cuts interest rates for the first time in five years but patience remains the most appropriate path! Eurozone inflation has made considerable progress toward its target. Christine Lagarde considered the Euro zone inflation is under control after slowing from a peak above 10% in 2022 to 2.5% in June. It is now appropriate to moderate the degree of monetary policy restriction. Christine Lagarde confirmed that the ECB is not pre-committed to a particular rate path. We remain confident in a gradual reduction in monetary policy restriction in the Eurozone.

The recent rise in political uncertainty in France has had a limited impact on corporate market. With a hung parliament, the market now considers that the risk of a significant budgetary slippage is very low.

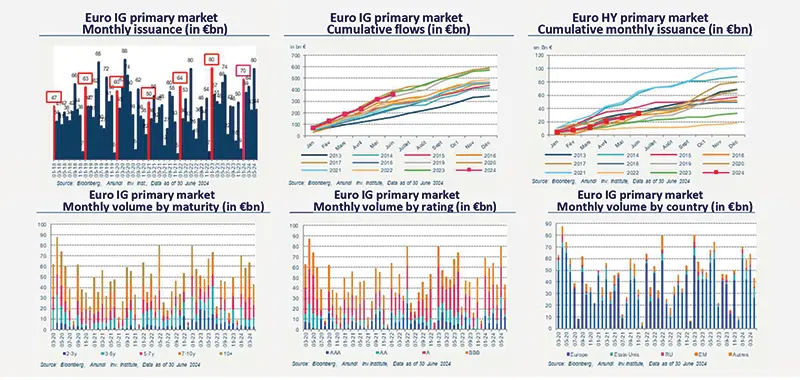

Activity on the corporate primary market remained solid.

Primary market Investment Grade

Market data

Find out about our treasury offer