Zusammenfassung

Highlights

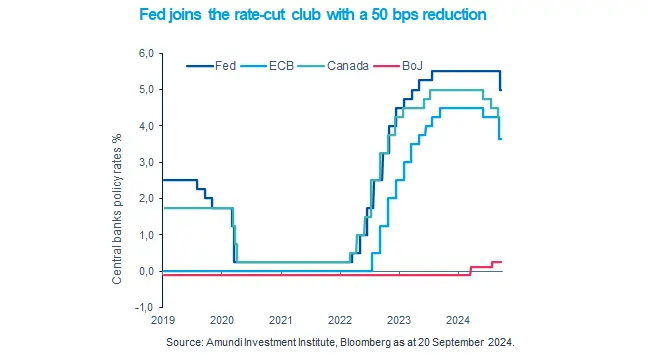

- The Fed cut rates in September for the first time since the Covid crisis, embarking on a new easing cycle.

- These rate cuts were echoed by other central banks in the UK and Canada in what appears to be converging policies.

- Despite these cuts, yields on US government bonds remain attractive from a long term perspective.

In this edition

The Federal Reserve (Fed) cut policy rates by 50 basis points (bps) in its latest monetary policy meeting in September. We believe the Fed is now confident that the battle against inflation is won. Importantly, the central bank downgraded its growth forecasts for this year and upgraded its expectations of unemployment rate. We think going forward the labour markets and economic growth may become a bigger concern for the central bank, given that inflation is comfortably moving towards its 2% objective. This is consistent with our views of a deceleration in the US economy, indicating that the Fed could maintain this trajectory.

Furthermore, this monetary easing stance is also reflected in policies of other global central banks such as the ECB, with the Bank of Japan being the only outlier.

Key dates

Retail sales: Germany and South Korea

US GDP, South Africa PPI

US core PCE, ECB CPI expectations, China industrials profits

Read more