Zusammenfassung

Highlights

-

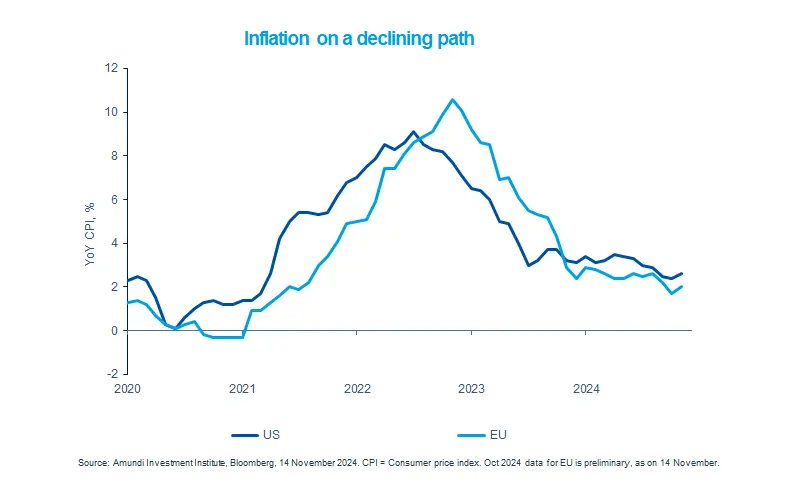

Price pressures in the US and eurozone are abating, although some inflation components could be volatile.

-

On the growth front, economic recovery in Europe will continue, and, the US is also likely to avoid a recession.

-

This scenario calls for a global approach and a balanced stance across the US and Europe.

In this edition

US CPI for October accelerated slightly to 2.6% owing to some sticky components around shelter. This latest data points to the volatility we expect around inflation (particularly if policies of new US administration are implemented), but we think the overall path is declining for now. In the eurozone, preliminary inflation data for October also points to a declining trend. While we believe the ECB could keep a close eye on data, the central bank could continue its monetary easing and reduce rates in December. These rate cuts, along with increases in real income (income less inflation), should boost household consumption and demand in Europe. We expect an uneven recovery across countries, with national policies playing a key role. In the US, a mild economic deceleration is likely. The overall environment is likely to remain benign.

Key dates

EZ and Canada CPI

South Africa policy, EZ consumer confidence

University of Michigan inflation, Mexico GDP

Read more